Trying to get the top best instant cash advance apps like Dave that will give you quick and immediate cash loan to meet urgent financial obligations before payday and you haven’t found one?

Just imagine waking up thinking it’s going to be just another day, but then your car breaks down. Your electricity bill arrives and it’s much higher than it usually is. You fall ill unexpectedly. An old friend comes into town and you have to go have a fun night out with them. You don’t have enough money to cover what you need and payday is still far away.

This is where Dave comes in. Dave helps you get through financial emergencies without throwing you under a pile of debt by providing interest-free cash advances.

In this article, we would help you out with our best 10 free cash advance apps like Dave in 2022 for your quick and emergency cash and with no credit check or with an extremely bad credit.

Summary List of Top 10 Free Cash Advance Apps Like Dave In 2022 And What They Are Best For.

#Rating List |

Application Name |

“Best For” Pick |

Loan Amount |

Credit Check |

| 1 | Chime Cash Advance App | Best for Overdraft Protection | $100 to $200 | No Credit Check |

| 2 | Earnin Cash Advance App | Best for Earning-based Borrowing | $100 to $500 | No Credit Check |

| 3 | Brigit Cash Advance App | Best for Budgeting Tools | $50 to $250 | No Credit Check |

| 4 | Empower Cash Advance App | Best for Quick Cash Advances | $25 to $250 | No Credit Check |

| 5 | MoneyLion Cash Advance App | Best for Multiple Financial Products | $50 to $250 | No Credit Check |

| 6 | Even Cash Advance App | Best for Employer-Based Advances | 50% of Next Paycheck | No Credit Check |

| 7 | PayActiv Cash Advance App | Best for Short-term Loans | Advances based on Hourly Earning | No Credit Check |

| 8 | Branch Cash Advance App | Best for Underbanked/Unbanked Employees | $50 to $500 | No Credit Check |

| 9 | DailyPay Cash Advance App | Best for Daily Earning Based Cash Advances | Advances based on Daily Earning | No Credit Check |

| 10 | Varo Cash Advance App | Best for Interest-free Cash Advances | $50 to $100 | No Credit Check |

Complete List of Top 10 Free Cash Advance Apps Like Dave For Small Cash Advances

Here is a list of the top 10 picks for free cash advance apps like Dave in 2022 for small and emergency cash advances. You can just choose just the best option that fits your need.

- Chime

- Earnin

- Brigit

- Empower

- MoneyLion

- Even

- PayActiv

- Branch

- DailyPay

- Varo

1. Chime

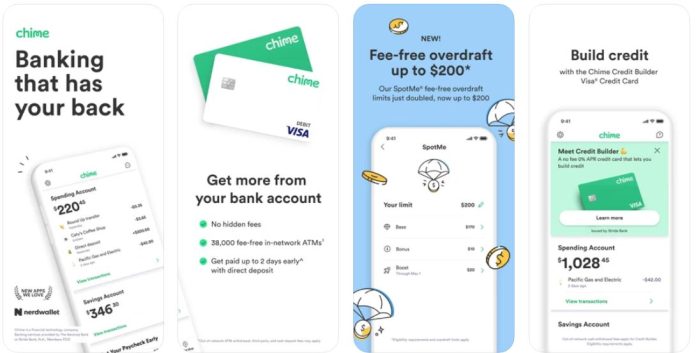

Chime is our 1st pick on our list of top 10 best free cash advance apps like Dave in 2022 with no credit check. The lending app works exactly like Dave. The maximum amount you can request is $200 but you have to start building your account to qualify.

However if you’re in urgent need of a little cash, Chime can lend you up to $100 before your paycheck arrives. With Chime’s Spot Me feature, you can overdraw up to $200 on your account depending on your repayment history.

Chime has been in the fintech business for almost a decade now serving as an online bank account where you can make direct deposits, transfer money, send checks, pay bills online and get a cash advance on your salary when you’re low on funds.

While Dave charges you a monthly subscription fee of $1 to maintain your account and Express fees between $1.99 and $5.99 for quick processing of your cash advance, Chime is completely free to use. It charges zero maintenance fees, transaction fees, minimum balance fees, or hidden fees.

To Apply for Chime loan, click here.

2. Earnin

Within 1-2 business days or even less depending on which option you opt for, you can get a cash advance with Earnin which is one of the most popular instant and free cash advance apps like Dave of 2022.

With Earnin, you can make any day payday by taking an advance on your pending earnings. The platform lets you borrow between $100 to $500 a day from your outstanding paycheck without having to deal with the excessive fees and interests of the usual payday loans.

All you have to do is log into the app, tell the company where you work and bank, and it’ll use location services or timesheets to calculate how much time you spent on the job that day.

Next, you’ll need to multiply the hours you worked by your hourly rate, and Earnin will advance the money you earned that day within one to two business days or instantly if you opt for the Lightning Speed feature.

To Apply for Earnin loan, click here.

3. Brigit

Brigit is one of the best instant cash advance apps like Dave that you can use. It works by letting you borrow money and pay it back when your next paycheck is deposited.

With Brigit Plus, you get a cash advance within 20 minutes whilst the standard accounts get it within 1 to 2 business days. To be able to request up to $250, you need to uograde to the $9.99 per month plus plan. It’s definitely one of the top instant cash advance apps like Dave you can get.

While Dave only gives you a maximum cash advance of $200 if you have a Dave spending account and $100 without one, Brigit offers up to $250. On top of that, Brigit allows you to extend the due date on your first loan once without incurring a penalty or late fee.

The more you use the service, you’ll be able to earn more extension credits that will let you postpone loan repayment up to three times in a row. Like Dave, Brigit charges a membership fee, but the price points and benefits differ greatly.

To Apply for Brigit loan, click here.

4. Empower

The process with Empower is simple. You can withdraw from $25 to $250 and you pay automatically when you receive your next paycheck. It’s our no 4 in our list of instant cash advance apps like Dave.

Want a quick cash advance but don’t want to deal with interest rates or late fees? Consider using Empower to receive up to $250 whenever you need a cash injection to take care of your bills and expenses.

When you apply for a loan on the platform the money will be disbursed to your Empower checking account free of charge or to an external bank account for a flat fee of $3. You can even get access to your paycheck two days earlier thanks to Empower’s Early Paycheck Deposit feature. Empower is definitely one of the top apps like Dave.

To Apply for Empower loan, click here.

5. MoneyLion

This is another top pick on our list of instant cash advance app like Dave. With it you can receive up to $250 and get started after you create a MoneyLion account. It’s highly recommended payday loan for credit access.

You can use MoneyLion to get cash advances whenever you have unplanned expenses that need sorting out. The service grants you instant loans of up to $250 per pay cycle depending on how much income you regularly earn and deposit into your checking account.

The process for getting a cash advance on MoneyLion is much faster than Dave by a few days. You can even receive the disbursement instantly or within a few hours if you have a RoarMoney account.

Compared to Dave which charges a $1 monthly fee to enable it to furnish you with loans, MoneyLion doesn’t require any fees or interest on cash advances. Instead, the company asks that you leave an optional tip whenever you get a cash advance so that MoneyLion can remain interest-free and available to as many users as possible.

MoneyLion doesn’t perform any kind of credit checks before, during, or after you request a cash advance, so you don’t have to worry about ruining your credit or getting disqualified for not having stellar credit.

To Apply for MoneyLion Loan, click here.

6. Even

Even is our 6th pick on the list of cash advance apps like Dave for emergency payday loans. Whether you need to fill your gas tank, pay a bill, treat yourself to a good time, or buy groceries, Even is there to help you deal with life’s surprises by giving you access to cash within minutes. The service puts its own unique spin on cash loans by advancing money from your unpaid wages.

To be eligible to borrow money from Even, you need to work for a qualifying employer. Even will then furnish you with an advance of up to 50% from your paycheck depending on your salary history.

Just like Dave, Even does not collect interest rates or taxes when you take a cash advance from the service. However, like its counterpart, Even requires a monthly subscription fee to enable you to cash out from the platform.

To Apply for Even Loan, click here.

7. PayActiv

One of the most attractive features of PayActiv is the fact that you can use the cash advance service during federal holidays and weekends in the US. It is our number 7 on our list of 10 top cash advance apps like Dave for free cash advances.

PayActiv is designed to help employers provide their employees with early access to their paychecks. However, you are still eligible to use the service even though your employers don’t have an account with PayActiv.

In this instance, you’ll have to apply for a PayActiv card to be able to receive a pay advance from your wages up to two days ahead of the due date.

Once you register on PayActiv, you’ll be able to view the number of hours you’ve worked and your current earnings from the app. Like Dave, PayActive doesn’t charge interests on cash advances, the amount withdrawn is simply deducted from your next paycheck.

To Apply for PayActiv Loan, click here.

8. Branch

Branch helps businesses accelerate payments and empower working Americans.

Branch app allows employees of participating companies to access part of their wages. This is deducted from their earned wages.

The platform is one of the best cash advance apps like Dave available in the market today and designed to help employees get faster access to their wages, keep track of payments and balances, get spending reports regularly, and receive alerts about upcoming bills.

This fintech platform is particularly useful for employers who have lots of underbanked or unbanked employees. It provides them with a free digital account and debit card for transactions.

Branch lets you withdraw up to $500 in advance per pay cycle of $150 per day based on how many hours of work you do and wages you earn. However, the catch is that your employer also has to set up an account on Branch.

To Apply for Branch Loan, click here.

9. DailyPay

If you’re looking for cash advance apps like Dave to help you solve urgent financial needs when you’re low on cash without attracting hefty overdraft fees on your account, DailyPay is one of the best options to consider and our 9th pick.

With DailyPay, you can get an advance on your earnings before your next payday and save over $1,205 in overdraft fees, loan interest, and late fees.

Whenever you clock in for a shift, your earnings for the day will be added to your DailyPay account. You can transfer the earned amount to your bank account any time you want and DailyPay will deduct the advances from your salary when payday comes around.

The app charges a modest transfer fee of $1.99—which is on par with what Dave charges—on each withdrawal to deposit your cash advance by the next business day. Alternatively, you can pay $2.99 for an instant transfer.

To Apply for DailyPay Loan, click here.

10. Varo

Varo gets the 10th position in our list of top 10 best instant and free money advance apps like Dave. With Varo, you can access up to $100 and you pay a fee depending on your advance. All of the advances must be paid within 30 days.

Once you set up a direct deposit on your Varo account, you’ll be entitled to withdraw any amount you want from your earned wages ahead of time.

The pay advances you receive from Varo are interest-free, just like the advances that Dave offers. You won’t even have to pay transfer fees, foreign transaction fees, or keep a minimum balance.

To Apply for Varo Loan, click here.

Conclusion: Drawing A Prallel Between Cash Advance Apps And Quick Loan Apps

The concept of app-based cash advance services is fairly new and is advocated by fintech startup companies. However, many consumers believe cash advance services and payday loans have more things in common than differences. In essence, cash advances and loan apps grant anyone access to money. And this is quite appealing for the economically vulnerable demographics. One difference between cash advances and loan apps is the charging of interest rates. Payday lenders are notorious in terms of putting an interest rate on borrowed money. Meanwhile, cash advance services encourage users to tip their early access to unpaid wages.

Both services are helpful if they can’t be helped. However, whether you are getting cash or payroll advances, or payday loans, the truth remains: if you borrow at the expense of your next paycheck, you are putting a hole in your next paycheck. Needless to say, you should only borrow the amount you can earn. That way, the strain is not as heavy as it should be.