The digital lending landscape in Nigeria is experiencing significant growth, despite challenges related to unethical practices by some lenders and borrowers’ failure to repay loans.

According to the Federal Competition and Consumer Protection Commission (FCCPC), 161 companies have received full approval to operate as digital lenders in Nigeria, with an additional 40 receiving conditional approval.

This brings the total number of approved loan apps in Nigeria to 201, excluding numerous unregistered apps operating without regulatory oversight.

These digital lenders offer collateral-free loans, a service traditional banks are often reluctant to provide.

Their quick loan disbursement, customized repayment plans, and minimal documentation requirements make them a popular choice for Nigerians in need of fast cash.

Several loan apps are currently available in Nigeria, with download figures reflecting their popularity.

Among these apps, five have crossed the 5 million download mark on Google Play Store as of August 2023:

- Branch: With over 10 million downloads, Branch offers quick online loans, determining eligibility and personalized loan offers using smartphone data. Interest rates range from 15% to 34%, and borrowers can access loans from N1,000 to N200,000 within 24 hours.

- Palmpay: Palmpay has also surpassed 10 million downloads and provides fast loan decisions within 15 seconds. Loan amounts for new borrowers typically start at N10,000.

- FairMoney: FairMoney offers fast loans within 5 minutes without documentation or collateral. The app has been downloaded more than 10 million times.

- Okash: Okash provides convenient online loans ranging from N3,000 to N500,000, with repayment plans spanning from 91 to 365 days. It has exceeded 5 million downloads.

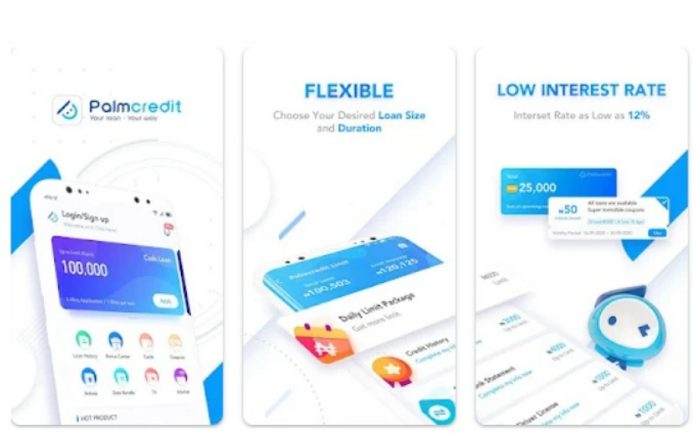

- Palmcredit: Palmcredit, with over 5 million downloads, offers quick loans of up to N300,000 in less than 3 minutes, without requiring collateral.

These loan apps play a vital role in meeting the financial needs of Nigerians, particularly those seeking access to credit without traditional bank requirements.

Despite concerns about unethical practices in the industry, these apps continue to gain popularity and expand their user base.