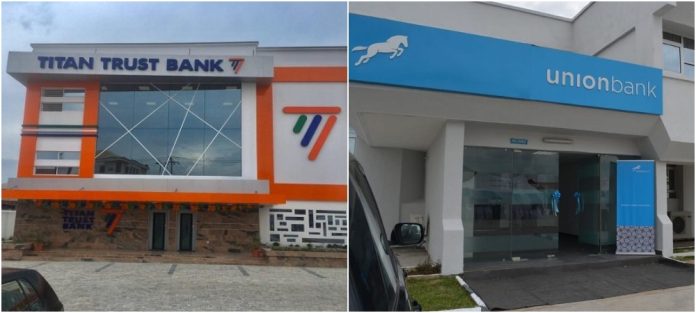

Mudassir Amray has been appointed as the new chief executive officer (CEO) of Union Bank following the sale of majority stakes to Titan Trust Bank Limited.

Somuyiwa Sonubi, Union Bank’s secretary, disclosed this in a statement to newsmen.

Top 10 Best Urgent Loan Apps In Nigeria Without Collateral For Emergency Cash.

Prior to his appointment, Amray led the establishment of Titan Trust Bank and subsequently became the bank’s pioneer CEO in October 2019.

In December 2021, Union Bank had announced that subject to regulatory approvals, it would “transfer 89.39 percent of its share capital to TTB”.

The agreement is between its majority shareholders — Union Global Partners Limited, Atlas Mara Limited, among others – and TTB.

Union Bank divests entire shareholding Of Its Subsidiary Union Bank (UK) Plc To Titan Trust Bank

Meanwhile, Union Bank also said it has completed the divestment of its entire shareholding interest (direct and indirect) in its subsidiary, Union Bank (UK) Plc, to all the shareholders in its records as of March 4, 2022, “pro rata to their existing shareholding interests in the bank”.

Consequently, UBUK is not included in the transaction with Titan Trust Bank, the financial institution said.

Union Bank also announced the retirement of directors from its board.

Beatrice Hamza Bassey retired from her position as chair/non-executive director while Emeka Okonkwo stepped down as CEO.

Commenting on behalf of the outgoing directors, Bassey, the erstwhile chair of the board, said: “I am very proud of all that we accomplished together during a transformative period for the Bank following the significant recapitalization of the Bank by the outgoing investors.

“We reshaped the Bank with significant investments in the technological infrastructure, hired a capable management team, attracted a talented and diverse work-force, established a first-rate governance structure, digitized the bank, introduced innovative products and channels to better serve our customers, became a leader in sustainability, attracted significant funding, especially with DFI partners, and launched the innovative Alpher Women’s Initiative which will help us further accelerate financial inclusion.”

Farouk Mohammed Gumel, chair, board of Nigeria Sovereign Investment Authority, was appointed as the new chairman of the board.

“Farouk Gumel is Group Executive Director for TGI Group. He is also the Chairman, Board of Directors at Wacot Rice Ltd, a subsidiary company of TGI Group, and Non- Executive Chairman at the Nigeria Sovereign Investment Authority (NSIA),” the statement reads.

“Prior to joining TGI, Mr. Gumel was a Partner at PwC and Head of the West African Advisory/Consulting business, covering Nigeria, Ghana, Liberia, Sierra Leone, and Angola.”

Obafunke Alade-Adeyefa, Richard Burrett, Ian Clyne, Kenroy Dowers, Paul Kokoricha, Taimoor Labib, Mark Patterson, and Emeka Ogbechie, among others, resigned as board members.

Andrew Ojei, Abubakar Mohammed and Lawrence Mackombo were appointed as non-executive directors of the company.

Do You Need Emergency Cash Loan From Reputable Urgent Loan Apps in Nigeria Without Collateral?

In need of an instant loan or an emergency cash loan in Nigeria? You can apply through any of the top loan apps in Nigeria and get funded under 3 hours, a few more hours or within 24 days. No hidden charges, no document needed, no collaterals needed with any of our list of reputable loan apps in Nigeria. One of such reputable emergency loan platforms is Taka loan.

There are many good urgent loan apps in Nigeria without collateral for emergency cash in 2022 designed for urgent and emergency cash if you are a Nigerian and live in Nigeria. An emergency cash loan is available for anyone who has an urgent financial obligation that cannot wait.

More urgent loan apps in Nigeria without collateral for emergency cash 2022

Read Also: Top 10 Best Reputable Betting Companies In Nigeria 2022

If you need more reputable and urgent loan apps in Nigeria without collateral for emergency cash for 2022 and with low interest, you can apply for quick cash loans from other platforms apart from ALAT By Wema app. However if you are a business owner, you can apply for a bigger loan amounts from Lendigo platform. The funds can be used to grow and expand your business.

We should also add that if you are a Nigerian or non Nigerian but resident in United States (USA), you can apply for an emergency cash advance loan even if you have a poor or bad credit rating. Please ensure you avoid like a plague any of the following top 22 loan sharks in Nigeria. They are scam, fraudulent and fake loan apps in Nigeria.

And if you ever planning to study abroad or you have someone who does, then check this out: Top Requirements For Nigerians Planning To Study Abroad In Germany. And if you are a student and need loan desperately even with bad credit, then this is for you. And if you are wondering which option of university to choose to study abroad,

this article will guide you.