A lot of people have asked, and still asking if it is possible for someone or a customer or borrower to stop loan apps from accessing your phone contacts after you have already downloaded their app and patronized their services? And then you later uninstalled the app.

I have personally received many messages and questions both online and offline many of them asking: How Can You Stop Loan Apps From Accessing Your Phone Contacts? After doing an extensive research and reading across board, I have therefore decided to address this question in this essay. Read on.

To stop loan apps from accessing your phone contacts again, safely uninstall the app and do not patronize them anymore. However your previous contacts remain in their database if you ever collected a loan from them.

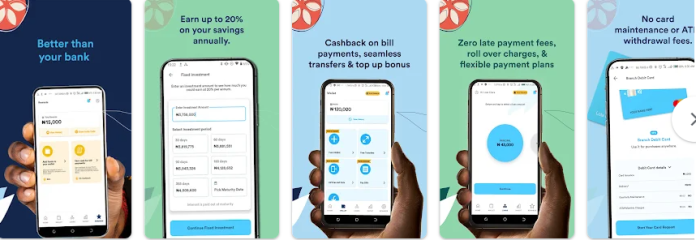

The ability of securing instant credit within minutes just after a few clicks on a loan app or a digital lending platform, and particularly without collateral or any form of documentation made these lending apps and online banks a darling of many people. It’s a not just a great excitement but a revolutionary innovation to know that you can access instant cash of say N50,000 or N100,000 at the corner of your room within a few clicks on your mobile phone without visiting any bank and without any physical correspondence.

How To Stop Loan Apps From Accessing Your Phone Contacts — How Phone Contacts Became The Ultimate Collateral In Event Of Repayment Default By Borrowers

What borrowers and indeed many Nigerians did not know, however, was that the hundreds or thousands of contacts (as the case may be) discreetly stored on their mobile phones or smart phones whether Android or Apple was the ultimate collateral in case of default for the various loans they have accessed.

The numbers stored on their phones and accessed by the loan apps in Nigeria, were the lenders’ insurance, guarantees and indeed collateral against any inability to repay or repayment defaults of any kind. In essence, borrowers’ reputation and dignity or whatever was to be left of it was to be used in guaranteeing and securing repayment of instant loans in event of default.

See below how a customer by name Isaac Ojo Obisesan was grossly humiliated by a loan app in Nigeria for defaulting his repayment as at when due. What collateral could have been more than this for any digital lending platform? Isn’t this enough to force repayment by a defaulter if only to avoid the gross shame, ridicule and defamation associated by a phony loan app all out to secure its loan disbursement?

How To Stop Loan Apps From Accessing Your Phone Contacts After You Have Borrowed Money From Them?

The truth is that your contacts “safely stored in your mobile phone” which you used in downloading the loan app and securing the lending from the app platform, is actually “your collateral and guarantee for loan repayment.” If you want to apply for a loan and you do not have any contact in your phone, we assure you that no lending app in Nigeria will approve your request.

What borrowers and indeed many Nigerians did not know, however, was that the hundreds or thousands of contacts (as the case may be) discreetly stored on their mobile phones or smart phones whether Android or Apple was the ultimate collateral in case of default for the various loans they have accessed.

The numbers stored on their phones and accessed by the loan apps in Nigeria, were the lenders’ insurance, guarantees and indeed collateral against any inability to repay or repayment defaults of any kind. In essence, borrowers’ reputation and dignity or whatever was to be left of it was to be used in guaranteeing and securing repayment of instant loans in event of default.

You may be asking: If I accidentally gave permission to an app to access my contacts and messages, how do I undo this?

If you are using an Android device and you have mistakenly downloaded a fraudulent app, then this is for you.

If you are indebted to any of those illegal loan platforms, and you are afraid of defamatory messages to your contacts.

Please kindly go to settings in your android phone, click on app & notifications. Scroll down to app permission and deny them access to your contacts, sms, photo gallery and storages on your phone, they won’t be able to reach out to your contacts anymore or post your pictures.

They would only have your number and have only you to deal with.

See below how a customer by name Isaac Ojo Obisesan was grossly humiliated by a loan app in Nigeria for defaulting his repayment as at when due. What collateral could have been more than this for any digital lending platform? Isn’t this enough to force repayment by a defaulter if only to avoid the gross shame, ridicule and defamation associated by a phony loan app all out to secure its loan disbursement?

So in essence and in simple answer to the question raised in this article, you cannot stop loan apps from accessing your phone contacts, after you have borrowed money from them. Your phone contacts will immediately be downloaded safely on the loan app’s external database against your name, BVN and other profile details and even though youn later delete or uninstall the loan app, it makes no difference. You stand in their mercy.

But you can still stop them from further accessing your phone contacts and other details you have granted permission to. To do this, simply scroll down to app permission and stop loan apps from accessing your contacts, sms, photo gallery and storages on your phone, they won’t be able to reach out to your contacts anymore or post your pictures. They would only have your number and have only you to deal with.

It could be a business partner, your customer or your client base, or even your family members, your loved ones and group members including hundreds and thousands of other people a person/customer would not want to get humiliated or threatened in their presence (because of loan default), but this, was the ultimate card the loan apps in Nigeria counted on to get repaid in case you defaulted. Their weapons are your actually your humiliation, defamation, threats and shaming, and the lending apps do these to you and to all your valued contacts including your family members to get paid back their loan.

Your only guarantee or tool to prevent or stop loan apps from accessing your phone contacts is to not download their apps on your phone and to not collect their loan. You already signed in and “approved your contacts for their database” once you hit loan approved on your phone.

Borrowers Recount Humiliating Ordeal From Loan Apps Accessing Their Phone Contact List In Nigeria After Default

“It is not a good experience,” said Jane, who defaulted on a loan. After the lender reached out to her phone contacts, to console herself, she said in a mixture of Pidgin and English; “Who no dey borrow? Even Nigeria dey borrow, it is a normal thing. But they should have focused on me paying their money and not reaching out to my contacts.” While she may have been humiliated beyond her imaginations, the psychological impact was a feeling of nothing else to lose.

To stop loan apps from accessing your phone contacts again, safely uninstall the app and do not patronize them anymore.

“Shame! Shame! Shame!” as may be recalled by Game of Thrones fans, was the chant as Cersei, the Queen Mother, was paraded through the fictional town of King’s Landing, as atonement for her ‘sins’. The same can be replayed, when hundreds or thousands of numbers on a person’s phone are contacted, all in a bid to shame a borrower into loan repayment.

“I was broke then and under pressure to settle certain things,” said Chidi, who borrowed N10,000 each from three of such apps in mid-2021, a total of N30,000 ($72) but defaulted after the 2-week tenor. This led to a tsunami of messages and calls, first to threaten him to repay, then to all his phone contacts. He identified iCoin as one of the apps but couldn’t recollect the others when interviewed.

“Christmas is over, if you know you borrowed money from any digital lending App, biko (i.e. please) go and pay back. I don’t want to receive unnecessary messages because of you. Walahi, I go carry them come your house,” wrote Collins Nnabuife on his Facebook page, intended as a joke but also a portrayal of the current reality many live through. Not only for those who have borrowed, but their phone contacts who are harassed with threatening messages, even when they were never used as guarantors for the loan.

Digital Lending Apps disregard Google, Nigeria’s laws, continue to blackmail borrowers

The post by Collins was not unconnected to messages he had received, including one about a female acquaintance, which among other things read; “This is to inform the general public that Miss Jane Doe (real name withheld) with phone number: 00000000 is a thief and dubious criminal currently on the run with companys (sic) money. She has been declining and avoiding company calls to pay back.

“Kindly notify her on getting this notice, as pictures of her will be posted on social media platforms today for criminal act and BVN number blacklisted on failure to pay back today. We will submit her relevant details publicly and treat as fraud.”

Some of the digital lending apps that have been reported to indulge in similar acts include; 9Credit, NairaPlus, Lcredit, NewCredit, ncash, Kash Kash, iCoin, xCredit, Mint, and Soko Loan, which was recently fined N10 million following petitions by aggrieved users.

How Loan Apps In Nigeria Are Flouting Google Policy On Finance Apps And Nigeria’s Local Lending Laws

While the apps mostly claim the lowest loan tenor is 91 days, in order to ‘pass’ Google playstore requirement for the apps to be hosted, all as recounted by ‘victims’, actually offer loans from seven days.

“We do not allow apps that promote personal loans which require repayment in full in 60 days or less from the date the loan is issued,” states Google on a web page on conditions for Financial Services apps. “We don’t allow apps that expose users to deceptive or harmful financial products and services,” it also says.

To stop loan apps from accessing your phone contacts again, safely uninstall the app and do not patronize them anymore.

Christmas is over, if you know you borrowed money from any loan App, biko (i.e. please) go and pay back. I don’t want to receive unnecessary messages because of you

Digital lending apps are required to indicate minimum and maximum period of repayment, maximum annual percentage rate, and other information, which most either misrepresent or omit. In particular, by offering loans of just seven days, for instance, these providers clearly flout a major criterion by Google that no tenor should be less than 60 days.

The amount a person is eligible to borrow is determined by the work they do and income. Also, when a person borrows and pays back, it qualifies them for another (higher) loan.

This was the strategy employed by Jane (mentioned earlier), who borrowed an initial N10,000, and repaid so she could be eligible for a higher amount of N20,000, on which she later defaulted. She told BusinessDay there was a sick relative in her care and there was no other person to provide money urgently needed the day she took the first loan. Someone she asked for help had recommended as app she called ‘Mint’.

To prevent defaulting on the payment after the one-week tenor, she borrowed from another person, used their money to pay the loan app, which qualified her for another loan. She would then take the second loan, this time N20,000 out of which she repaid the person.

The second loan was the source of her humiliation, but, curiously, after she had been thoroughly embarrassed, she now appears indifferent.

“I’m not worried anymore. After all, they already did their worst by sending out messages to all my contacts,” Jane said. “As they sent out messages to my contacts, I told them as punishment, I will not repay till after the Christmas and New Year festivities.”

A Google spokesperson, when asked for the company’s reaction to conducts of loan apps hosted on playstore, told BusinessDay the company has very strict policies that guide apps that are allowed on the Playstore platform. “When we find violations, we take very strong actions, including sometimes taking down the app from our platform. Violations can be reported by clicking the ‘Flag as inappropriate’ link under the menu on the Google Play store. When reports are received, We investigate, and take clear actions,” Google said.

Apart from violating the terms by Google playstore, the digital lending apps have also been alleged to contravene Nigeria’s data privacy law on one hand, and cyber security law on the other.

When Soko loan, one of the loan apps was fined N10 million by NITDA, it was hinged on complaints by users who accused it of breaching their privacy and defaming them by reaching out to their phone contacts.

“This action was taken after receiving series of complaints against the company for unauthorised disclosures, failure to protect customers’ personal data and defamation of character as well as carrying out the necessary due diligence as enshrined in the Nigeria Data Protection Regulation,” NITDA said in August, 2021. Months later, the action taken against Soko loan has not deterred other loan apps from similar practices.

However, an August 2021 publication on the legality of the fine imposed by NITDA on Soko loans, by Aluko & Oyebode, a law firm, suggested the decision may be flawed, citing some other cases. But the question remains, what can be done and who will rein in the excesses of the loan providers many now refer to as unethical loan sharks.

“As for the ‘loan defaulters’, whether their right to privacy has been breached depends on the terms and conditions they agreed upon before the loan or facility was given out. If you agreed for the lender to have access to your contacts in the event of default, I see no reason why you should complain,” was the view of Olaitan Akinnubi, a Lagos-based lawyer.

He however said, “Where I think the lenders go too far, is sending unsolicited messages to ‘innocent’ contacts who they have no business or relationship with. This, in my opinion is an invasion of privacy.”

An example of such messages sent to Akinnubi by Xcredit, read; A chronic thief and fraudster, ………, of …………… street, Lagos, (phone number), used you as an emergency contact and has absconded with the company’s money. Inform him to pay back now else he would be arrested and you would be implicated and sanctioned.

“Associating me with an alleged ‘chronic thief and fraudster’ and also threatening to ‘implicate and sanction’ me constitutes an harassment or what you can say is cyber bullying,” according to him.

He further explained that section 24 (1) (b) of the Cybercrimes Act 2015 provides thus: “Any person who knowingly or intentionally sends a message or other matter by means of computer systems or network that he knows to be false, for the purpose of causing annoyance, inconvenience, danger, obstruction, insult, injury, criminal intimidation, enmity, hatred, ill will or needless anxiety to another or causes such a message to be sent: commits an offence under this Act and shall be liable on conviction to a fine of not more than N7,000,000.00 or imprisonment for a term of not more than 3 years or to both such fine and imprisonment.”

For LCredit, You Can’t Stop Loan Apps From Accessing Your Phone Contacts, The Platform Has Become Notorious For Blackmailing Borrowers

Recently an LCredit customer who lives and works in Lagos, Foluke Abosede Tijani (not real names) has lamented that the now known notorious digital lending app should stop blackmailing borrowers. She wants the Federal Government to stop loan apps from accessing your phone contacts.

According to Foluke who just sent her message to QUICK LOAN ARENA says he received a blackmail and threat message from the digital loan app today about a loan that has just fallen due within 24 hours.

The customer who has just lost her job is lamenting the threat from LCredit digital lending platform and calling on Nigerian government to prevail on quick loan apps and platforms to be ethical and stop blackmailing borrowers, urging them to play according to the rule and be fair to their customers who are going through hard and harsh times.

She isn’t denying the loan but said it just fell due and she just lost her job and need a few days to redeem it.

Read the message from LCredit loan app below:

Good Day AXXXX FXXX, This is L CREDIT.

You have BREACHED OUR AGREEMENT? You have 1 hour to pay your PRINCIPAL AMOUNT or PAY A REASONABLE PART PAYMENT but failure to do so, THE COMPANY WILL;

1. BE CALLING AND SENDING THIS MESSAGE BELOW TO ALL OVER SOCIAL MEDIA AND TO ALL YOUR CONTACTS WITH YOUR PICTURE ATTACHED TO IT.

(This is to inform the General Public that a Serial Loan Defaulter who is Foluke Abosede Tijani with phone number 08035579133 has vowed never to pay “L CREDIT” their money and he’s wanted. Please distance from him because he’s not to be trusted in anything business/Money.

If found, please kindly Call/WhatsApp this number 08068493746 or Report to the nearest POLICE STATION).

2. SEND YOUR BVN TO CREDIT BUREAU FOR BLOCKING, BLACKLISTING, PUTTING AUTO DEBIT ON YOUR BVN AND MARKING IT CRIMINAL RECORD. MEANING YOU WON’T BE USING BANK AGAIN IN NIGERIA

3. SEND YOUR DETAILS/BVN TO EMBASSY. THEY WILL KEEP DENYING YOU, YOUR KIDS (BORN/UNBORN) VISA TO TRAVEL OUTSIDE NIGERIA BECAUSE OF THE CRIMINAL RECORD IN YOUR BVN AND FOR GOING AGAINST THE LOAN POLICY OF CREDIT BUREAU (CB).

TO AVOID THOSE EMBARRASSMENTS, PLEASE PAY YOUR PRINCIPAL NOW OR PAY A REASONABLE PART PAYMENT IMMEDIATELY THROUGH YOUR APP OR TO THE ACCOUNT DETAILS BELOW…

Frequently Asked Questions: How You Can Stop Loan Apps From Accessing Your Phone Contacts?

We have attempted to answer a few common questions on how you can stop loan apps from accessing your phone contacts. Why the answers are not direct, they are situational and based on what previous actions you have taken.

1. Can You Stop Loan Apps From Accessing Your Phone Contacts?

The simple answer to this question is a NO! Provided you have once downloaded the loan app and have collected a loan from the platform. You can no longer stop the loan app from accessing your phone contact because it is already safely stored in the app’s external database. Even though you later uninstall the app, it is still with them. The best you can do is stop collecting their loan and repay any outsanding loan to avoid any further harrassment, threat or blackmail.

2. How do I get loan apps to stop calling my contacts? How do you stop loan apps from accessing your phone contacts?

To stop loan apps from accessing your phone contacts or calling your contacts and family members, do the following:

- Don’t download any loan app on your phone.

- If you have already downloaded a loan app, don’t approve or collect any loan from the platform.

- If you have already collected a loan from the platform, delete and uninstall the app immedialy from your phone and do not reinstall or collect any further loan from the credit platform.

- Only download and patronize reputable loan apps that will not send shame or defamatory messages to your contacts, even if they have your phone contact access.

3. Can a loan app access my contacts if uninstalled?

A loan app cannot access your contact list if you already uninstalled the app from your phone. However it’s likely your contacts have been downloaded and stored in the app’s database outside your phone if you ever collected a loan from them. To stop loan apps from accessing your phone contacts again, safely uninstall the app and do not patronize them anymore.

4. Can loan apps come to my house?

A loan app cannot come to your house. However if you already downloaded their app and collected their loan, they can access your contact list, databases, BVN, profile details and can report you to the credit bureau and blacklist your name against your BVN if you default on your loan. To stop loan apps from accessing your phone contacts again, safely uninstall the app and do not patronize them anymore.

5. How do I stop messages from loan apps?

To stop messages from digital lenders or stop loan apps from accessing your phone contacts again, safely uninstall the app and do not patronize them anymore. Also if you are owing any outstanding loan, pay down and let the app be aware that you have paid your loan to update your records.

6. How to stop a loan app from accessing your contact?

- Don’t download any loan app on your phone.

- If you have already downloaded a loan app, don’t approve or collect any loan from the platform.

- If you have already collected a loan from the platform, pay back any outsanding balance, delete and uninstall the app immedialy from your phone and do not reinstall or collect any further loan from the credit platform.

- Only download and patronize reputable loan apps that will not send shame or defamatory messages to your contacts, even if they have your phone contact access.

7. Can Denying Loan Apps Permission Stop Them From Calling or Messaging Your Contacts?

YES. Once you deny a loan app permission to access your contact list, you automatically stop them from accessing, calling or messaging your contacts. However if you deny any lending platform permission from accessing your contact, your loan will NOT be approved and you won’t get any funding from the loan app. So you have to decide on which one is more important to you.

8. How Do I Prevent Fake Loan Apps Like Sokoloan, LCredit and others From Calling Or Messaging My Contacts?

To stop loan apps from accessing your phone contacts generally or specifically stop scam platforms like Sokoloan or LCredit from messaging your list, do not download their apps on your phone. Do not approve or collect any loan from them. Do not give them permission on your phone to access your contacts. That essentially means you cannot have access to collect their loans.