When living paycheck to paycheck, an unexpected expense can significantly disrupt plans. Cash advance apps are a short-term solution to cover those unexpected expenses.

One common way to cover expenses until the next paycheck is to borrow money that you repay with a future paycheck. Payday loans and cash advance apps both allow you to borrow money ahead of the next payday. With a payday loan, lenders charge high annual percentage rates (APRs) to borrow money. These high fees can lead to more long-term financial trouble, since they can build up into greater debt.

When you need emergency financing, it increases your chances of falling victim to predatory lenders.

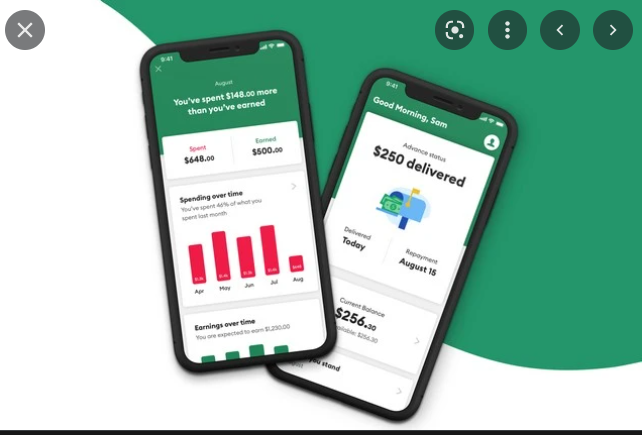

Cash advance apps are a newer development that similarly provide fast cash ahead of your next paycheck, but tend to charge much lower fees than payday loan lenders or none at all. The app makers earn money off of voluntary “tip” payments or membership fees, rather than interest. The lower costs, in tandem with inflation outpacing wages and persisting financial difficulties caused by the coronavirus pandemic, may be why cash advance apps are becoming increasingly popular.

Cash advance apps for bad credit or with no credit check such as Dave, SoLoFund, Brigit, Earnin, Empower, Albert and MoneyLion, etc care more about your cash flow and ability to repay from your next paycheck, other than your credit score, so if you have bad credit or extremely low credit score, it won’t affect your ability to qualify for a cash advance until your mext pay day.

In addition, while cash advances are similar to payday loans, the former often have 0% APRs while payday loan providers take advantage of borrowers’ desperation and often trap them in a cycle of debt with APR sometimes up to 400%. However, avoiding the mistake is easier than you think. As a helpful tip, pay close attention to your loan terms and stay away from payday loan products that have 400% APRs or more. Likewise, the options below can hold you over until your next paycheck arrives without impairing your financial health.

In this article, we would be reviewing the best instant cash advance apps with no credit check or with bad credit which you can easily download and access cash in case of emergencies or whatever financial need or obligation you might need the lending apps for. With these apps, you can easily access between $50 to $200 instantly with even a bad credit score.

Summary of Analysis of Top 10 Best Instant Cash Advance Apps With No Credit Check

S /No. |

Cash Advance App |

Loan Amount |

APR |

FEES |

| 1 | Dave | Up to $250 | 0% |

|

| 2 | SoLo Funds | Up to $500 | 3% – 10% |

|

| 3 | Brigit | Up to $250 | 0% |

|

| 4 | Earnin | Up to $150/Day or $500/Period | 0% |

|

| 5 | MoneyLion | Up to $250 | 0% |

|

| 6 | Possible Finance | Up to $500 | 150% – 200% |

|

| 7 | Empower | Up to $250 Line of Credit | 0% |

|

| 8 | Albert | Up to $2500% | 0% |

|

| 9 | Cleo | Up to $100 | 0% |

|

| 10 | Chime | Up to $200 | 0% |

|

Complete Analysis Of Top 10 Best Instant Cash Advance Apps With No Credit Check That Loan You Money Instantly In 2022

Looking for a comprehensive list of the top 10 instant cash advance apps with no credit check or with bad credit that can loan you money instantly in 2022? Below are the top highly rated ten (10) instant cash advance apps that require no credit check.

-

- Dave — Best for Overdraft Protection

- SoLo Funds — Best for Peer to Peer Loan funding

- Brigit — Best for Same-day Loans

- Earnin — Best for Earning-based Borrowing

- MoneyLion — Best for Multiple Options

- Possible — Best for Quick Cash Advances

- Empower — Best for No Interest and No Credit Risk

- Albert — Best for No Late Fees

- Cleo — Best for Quick Instant Loans

- Chime — Best for Best for Zero Membership and Banking Fees

1. Dave — Best for Overdraft Protection

| Loan Amount: | Up to $250 |

| APR: | 0% |

| Terms: | Repay manually or with your next paycheck |

| Fees: |

|

| Credit Check: | No |

| How to Qualify: |

|

| Link External Bank Account: | Yes |

If overdraft fees are cutting into your budget, Dave can help. Dave’s app looks for potential overdrafts, like an upcoming bill, and alerts users before their accounts are overdrawn. The app also provides a Yours to Spend summary, a personalized budget that factors in income and past expenses to estimate how much users can spend freely.

Dave is one of the best instant cash advance apps with no credit check, but will still loan you money instantly, Dave should be on your radar. For example, the cash app lets you borrow up to $250 with no interest or credit check. However, you need to have some money left after paying your monthly bills. In addition, the membership fee is $1 per month. However, Dave is a safe and legit way to receive cash for free within three business days, and you also have the option to pay a fee for same-day funding. On top of that, the Dave app should be available in all states, and you can link an external bank account.

But does Dave work with Capital One? Yes. Whether you bank with Capital One, Chase Bank, Wells Fargo, or several financial institutions, you shouldn’t have any issues setting up an account with Dave. Also, a bonus is that you can repay the advance manually or have the money automatically deducted from your next paycheck.

Pros:

- Dave is one of the best apps that gives loans up to $250.

- Dave doesn’t charge interest or check your credit.

- Standard three-day funding is free.

- You can link an external bank account.

Cons:

- You need to pay $1 per month in membership fees.

- It costs $1.99 for instant cash advances of $5 or less to $5.99 for $100 to $250.

Conclusion

Before payday, Dave is a trusted cash advance app that can give you extra cash but unlike other instant cash advance apps with no credit check on our list, it requires a $1 membership fee. Get the Dave cash advance app here.

2. SoLo Funds — Best for Peer to Peer Loan funding

| Loan Amount: | Up to $500 |

| APR: | Typically 3% to 10% |

| Terms: | Up to 15 days |

| Fees: | Late payment fee is 15% of the loan amount + $5 |

| Credit Check: | No |

| How to Qualify: | Depends on the P2P lenders’ criteria |

| Link External Bank Account: | Yes |

Top on our list of instant cash advance apps with no credit check, which also allow you borrow money instantly, is SoLo Funds which offers $50 to $500, and there is no minimum credit score requirement. In addition, repayment terms of 15 days or less are available, and tips typically range from 3% to a 10% maximum. Thus, Solo Funds is excellent if you’re looking for apps that pay you real money without worrying about high APRs.

For your reference, SoLo Funds is a peer-to-peer (P2P) lender that connects borrowers with investors. Moreover, the app should be available in all states, and applicants with low or no credit scores are welcome to apply.

However, late payment fees will cost you 15% of the loan amount plus $5. In addition, you can’t roll over your loan if you default, and the repercussion is often losing access to the apps’ services.

Pros:

- SoLo Funds’ cash app offers up to $500 with no credit check.

- Tips are 3% to a 10% maximum, much less than payday loan APRs.

- Same-day funding is often available.

- You can link an external bank account.

- You’re not charged a monthly membership fee.

Cons:

- Late payment fees will cost you 15% of the loan amount plus $5.

- Independent lenders determine approval on the platform.

Conclusion

SoLo Funds allows you to borrow money instant from your friends and pay them with “tips” rather than a scary interest rate. However, you need to be careful since these tips can be sky-high (you don’t want to pay as much as you would for a payday loan).

The maximum amount is $1,000 and it’s incredibly simple to do. You’ll have to describe why you need the money but that is easily done! You can get the SoLo Funds app here and apply easily for your instant loan.

3. Brigit — Best for Same-day Loans

| Loan Amount: | Up to $250 |

| APR: | 0% |

| Terms: | Repay manually or with your next paycheck |

| Fees: | $9.99 monthly membership fee |

| Credit Check: | No |

| How to Qualify: |

|

| Link External Bank Account: | Yes |

Brigit is our 3rd pick in the list of top 10 instant cash advance apps with no credit check that will always loan you money instantly even with your bad credit score, it doesn’t check nor care.

However, you need to become a member to apply, and the membership fee is $9.99 per month. But like Dave, you can repay the advance manually or have the money automatically deducted from your next paycheck. In addition, the Brigit app should be available in all states. And while its proprietary “Brigit Score” determines whether you qualify, a reasonable score of 40 or more should be enough to gain approval.

Pros:

- Brigit’s loan app provides up to $250.

- Brigit doesn’t charge interest or check your credit.

- You receive the funds in as little as 20 minutes without paying a fee.

- You can link an external bank account.

Cons:

- You need to pay $9.99 per month in membership fees.

- Most qualifying applicants have a Bridgit score of 40 to 100.

Conclusion

Brigit lets you borrow $250 the same day you apply for it — provided your application is submitted before 10 a.m. EST. However, you need to use the company’s monthly paid plan to access this feature. Get the digital lending app here on the App Store and here on the Google Play Store.

4. Earnin — Best for Earning-based Borrowing

| Loan Amount: | Up to $100 per day and $500 per pay period |

| APR: | 0% |

| Terms: | Repay manually via money order or with your next paycheck |

| Fees: | Up to $3.99 per $100 for same-day cash advances (first is free) |

| Credit Check: | No |

| How to Qualify: | Have a checking account with frequent direct deposits |

| Link External Bank Account: | Yes |

Earnin is our 4th pick on the list of top instant cash advance apps with no credit check apps with no credit check in the USA and it comes with so many features such as the cash-out option. With Earnin you can easily access up to $500 of your paycheck.

Earnin app allows you to borrow against your next paycheck quickly without any fees or interest payments attached.

When users sign up for the app, Earnin connects their bank accounts to verify their payment schedules. The app calculates users’ hours by tracking how long they’re at work using their phone’s GPS or by allowing them to submit a timesheet. It then determines hourly pay rate based on how much money the user receives in direct deposit.

Earnin provides safe and legit access to $100 per day or $500 per pay period. Moreover, there is no interest or credit check, and you can repay the advance manually via money order or have the funds deducted from your next paycheck. Furthermore, since there is no monthly membership fee, Earnin is one of the best apps that loan you money instantly.

Pros:

- Earnin’s loan app provides $100 to $500 in cash.

- Earnin doesn’t charge interest or check your credit.

- Your first same-day cash advance doesn’t incur a fee.

- You can link an external bank account.

- You’re not charged a monthly membership fee.

Cons:

- Earnin requires several identity and location disclosures.

- You’ll pay up to $3.99 per $100 for subsequent same-day cash advances.

Conclusion

Earnin as one of the leading instant cash advance apps with no credit check has a unique lending system. Its app tracks the number of hours you have worked and allows you to access your money according to your earnings. Plus, the app has a notification feature that alerts you in case your bank balance is low. The app allows you up to $100 per day and $500 per pay period. Get the lending app here.

5. MoneyLion — Best for Multiple Options

| Loan Amount: | Up to $250 |

| APR: | 0% |

| Terms: | Repay with your next paycheck |

| Fees: | $1.99 to $7.99 for immediate cash advances |

| Credit Check: | No |

| How to Qualify: |

|

| Link External Bank Account: | Yes |

MoneyLion app offers mobile bank and investment accounts, financial tracking, a credit-builder loan and cash advances up to $250 with no interest or credit check,. The Instacash advance is available to anyone with a qualifying checking account. However, you’ll have to pay a fee if you need your funds quickly. MoneyLion says it charges no interest or fees with the cash advance, but you’re asked to provide an optional tip if you get an advance.

With MoneyLion, you don’t have to repay the funds until payday. However, since the app restricts new accounts to $25 or slightly higher when you sign up, consider it a $50 loan instant app until you build a reliable relationship.

Pros:

- MoneyLion’s loan app provides up to $250.

- MoneyLion doesn’t charge interest or check your credit.

- You can link an external bank account.

- You’re not charged a monthly membership fee.

Cons:

- You’ll pay $1.99 to $7.99 for instant cash advances.

- You may only qualify for $25 right away.

Conclusion

Besides offering you a loan, MoneyLion has many other features, such as financial tracking and investment accounts.

- Amount: $50 to $250. You can access larger loan amounts if you have a RoarMoney account or become a Credit Builder Plus member.

- Processing Time: If you have a RoarMoney account, you’ll get your loan in 24 to 48 hours, and if you choose to have the money deposited to an external account, it will take 3 to 5 days. You can also opt to have your money in minutes to within a few hours by paying a Turbo Fee.

- Repayment: On your next payday.

- Fees: You can pay an optional tip. Plus, there’s a $3.99 fee for instant delivery if you’re an account holder and $4.99 if not.

The maximum amount a user can access on MoneyLion is $250 but to access a higher amount you would have to pay a $1 per month membership fee. If you need to get an instant cash advance with no credit check from MoneyLion, get started here.

6. Possible Finance — Best for Late Payments

| Loan Amount: | Up to $500 |

| APR: | 150% – 200% |

| Terms: | Eight weeks + 29-day grace period |

| Fees: | None |

| Credit Check: | No |

| How to Qualify: |

|

| Link External Bank Account: | Yes |

While loan amounts vary by state and won’t exceed $250 in California, Possible Finance, our 5th pick for instant cash advance apps with no credit check, typically provides up to $500 with no credit check. However, APRs range from 150% to 200%, and you repay the proceeds in eight weeks.

Also, there is a 29-day grace period if you suffer a financial emergency, and payday loans have an average APR of 400% and require you to repay the money with your next paycheck. Thus, while PossibleFinance’s APRs are high, the lender’s products are cheaper than a payday loan. And because of that, PossibleFinance should be considered one of the best apps that loan you money instantly.

Pros:

- Possible Finance’s loan app provides up to $500.

- There is no credit check.

- There is a 29-day grace period for late payments.

- You can link an external bank account.

- You’re not charged a monthly membership fee.

Cons:

- You will incur APRs of 150% to 200%.

- Maximum loan amounts vary by state.

Conclusion

To qualify for a cash advance with no credit check from Possible Finance, you need to have a checking account history of at least three months and direct deposits of $750 per month or more. Also, it’s preferable to have a balance surplus each month.

In addition, loans are only available in select states; its disclosures revealed: “At the moment Possible is available in Alabama, California, Delaware, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah, and Washington.”

You can apply for Possible Finance payday loans here.

7. Empower — Best for No Interest and No Credit Risk

| Loan Amount: | Up to $250 |

| APR: | 0% |

| Terms: | Repay manually or with your next paycheck |

| Fees: | $8 monthly subscription |

| Credit Check: | No |

| How to Qualify: |

|

| Link External Bank Account: | Yes |

Empower is our no 7th pick in our top list of instant cash advance apps with no credit check with guaranteed approval and immediate loan.

You can receive a cash advance from Empower up to $250, which you’ll immediately reimburse when you get paid. There are “no interest, no late fees, and no risk to your credit,” as the website advertises.

However, there is a $8 monthly subscription cost, so you should consider whether the program is worthwhile before signing up. You are paying a monthly cost for Empower’s features, which include savings, budgeting, and expense-tracking tools, despite the website’s claim that “The $8 price is for the banking and budgeting tools and does not have an association with advancing.”

Conclusion

Empower is one of the top instant cash advance apps with no credit check that gives up to $250 with no interest and even if you are late to make payment, the fees or charges aren’t high. Moreover, you can use the Empower card to get up to 10% cash back on purchases at specific merchants. The card also offers free transactions at 37,000 ATMs across the country. Even better, Empower cardholders get their paychecks up to two days early.

You need to borrow a cash advance before payday, Click to get started.

8. Albert — Best for No Late Fees

| Loan Amount: | Up to $250 |

| APR: | 0% |

| Terms: | Repay manually or with your next paycheck |

| Fees: | $6.99 per cash advance to an external bank account |

| Credit Check: | No |

| How to Qualify: |

|

| Link External Bank Account: | Yes |

Albert, our 8th pick for instant cash advance apps with no credit check but guaranteed approval to loan you money immediately, designed its products to take the complexity out of your financial life. It offers instant cash advances, auto repayment and there’s never a late fee.

It has the following features:

- Amount: Up to $250

- Processing Time: Instantly, which may incur a fee or within two to three days for free

- Repayment: Auto repayment on your next pay date

- Fees: No fees to advance cash instantly if you advance it to Albert Cash; instant advances to an external account will pay a small fee.

Regardless, Albert’s cash app can help assist until payday, and the app should be available in all states. Also beneficial, Albert doesn’t have monthly membership fees, so you don’t need a premium membership to access cash advances.

To qualify, you have to link a bank account with a positive balance open for two months or more. Moreover, regular direct deposits from the same employer are a must, and Albert also requires an account surplus the day after your paycheck arrives.

Pros:

- Albert’s loan app provides up to $250.

- Albert doesn’t charge interest or check your credit.

- You can link an external bank account.

- You’re not charged a monthly membership fee.

Cons:

- It costs $6.99 to have your cash advance sent to an external bank account.

- You may not qualify for the total amount right away.

Conclusion

As another of the best cash advance apps that pay you real money without a credit check, Albert advances up to $250 with no interest, your bad negative or credit nonetheless. Moreover, free deposits occur within two to three business days, though there is a “small fee” for instant funding. In addition, if you bank with Albert, there are no administrative fees. However, if you deposit the cash in an external bank account, a $6.99 fee will apply.

9. Cleo — Best for Quick Instant Loans

| Loan Amount: | Up to $100 |

| APR: | 0% |

| Terms: | Repay manually or with your next paycheck |

| Fees: |

|

| Credit Check: | No |

| How to Qualify: | Cleo’s algorithm analyzes your spending habits, payroll, and how well you budget |

| Link External Bank Account: | No |

Cleo is our 9th pick on the list of top 10 best instant cash advance apps with no credit check for guaranteed loan approval.

When analyzing apps that borrow money, Cleo is another winner, and the app should be available in all states. Moreover, while you may only obtain $20 to $70 until you build a reliable reputation, you can receive up to $100 with no interest or credit check later.

However, Cleo has a $5.99 monthly membership fee, and instant cash advances also cost $3.99. In addition, Cleo doesn’t list any options to link an external bank account, so you may have to set up more than one Cleo account.

Pros:

- Cleo’s loan app provides up to $100.

- Cleo doesn’t charge interest or check your credit.

- Standard four-day funding is free.

Cons:

- You need to pay $5.99 per month in membership fees.

- Instant cash advances cost $3.99.

- You can’t link an external bank account.

Conclusion

Cleo is one of the best apps that gives loans, and Cleo Plus members can earn back their monthly membership fee by taking advantage of exclusive cash-back shopping offers. For example, you can often earn more than $5.99 by using Cleo’s in-app cash-back coupons. In addition, you can repay the advance yourself or have Cleo automatically deduct the proceeds from your next paycheck.

10. Chime — Best for Zero Membership and Banking Fees

| Loan Amount: | Up to $200 |

| APR: | 0% |

| Terms: | Repay with your next paycheck |

| Fees: | None |

| Credit Check: | No |

| How to Qualify: | Have a checking account with Chime |

| Link External Bank Account: | No |

Chime is the 10th best pick for instant cash advance apps with no credit check that loan you money instantly.

Chime is a mobile company that offers checking and savings accounts, as well as credit-builder loans, lets customers overdraw their checking account by a small, predetermined amount without fees via its SpotMe feature. SpotMe is more of an overdraft protection feature than a cash advance, but it still asks if you want to tip for the service. Chime says your account can go negative up to your approved amount, and purchases that put you below that extra cushion will be declined. You need at least $200 in qualifying direct deposits to your Chime account every month to qualify for SpotMe.

If you already bank with Chime, its SpotMe program is a safe and legit way to obtain $200 in overdraft protection, and the app should be available in all states. Moreover, there are no fees, interest, or credit checks, and debit purchases and cash withdrawals are eligible. And avoiding the monthly membership fee can help save you a bundle.

Conclusion

Another option if you need an emergency fund instant cash advance apps with no credit check is to use Chime and this is best for those who want to avoid all those banking fees. The SpotMe service in the Chime app allows you to overdraft up to $200 but $20 for new users. To access instant cash advance from Chime, Get started here.

Conclusion on Instant Cash Advance Apps With No Credit Check

Instant cash advance apps with no credit check front you money until your next paycheck arrives. So you should think of them as short-term funding products that help you overcome emergencies. You need to have employment or self-employment income or receive recurring government benefits to qualify. That way, the lender knows that you can repay the proceeds.

However, many of the companies on our list don’t charge any interest, so if you’re in a tight spot and need instant funding, cash advance apps can offer safe and legit bridge financing.

Every cash advance app has its pros and cons, so it’s important to do your research and pick the one that works best for you. Make sure you read the terms and conditions and don’t borrow more than you’ll be able to repay.

Frequently Asked Questions (FAQs) About Cash Advance Apps With No Credit Check

Is There a Difference Between Loan Apps and Payday Loans?

Yes. Shady lenders often disguise their products as cash advances. However, it’s a scam that’s easy to avoid. That’s why we only list safe and legit cash advance apps, and the majority of the companies on our list don’t charge interest. Conversely, payday loans have an average APR of 400%, and you’ll find this out when unscrupulous lenders reveal the loan’s expensive terms. Therefore, please avoid these companies as they often trap borrowers in a vicious cycle of debt. In contrast, if a cash advance app has a 0% APR and little or no fees, you know it’s a reputable lender.

In addition, since payday loans often require repayment in 15 days, and the amount you can borrow is typically only a few hundred dollars, it’s easy to confuse the product with a loan app. However, the significant difference is that most cash advances are interest-free, while payday loans have an average APR of 400%. Moreover, even if we factor in monthly membership fees, cash advance apps’ all-in APRs are roughly 6% to 60%. Thus, a two-week advance through a loan app is more affordable than a payday loan.

Likewise, penalty fees are often much higher with payday loans than cash advances. As a result, the compounding effect of payday lenders’ practices often impairs borrowers’ financial health. And before they know it, a $300 payday loan incurs more than $300 in interest, fees, and charges. Thus, even if it’s an emergency, we recommend that you avoid payday loans, as there are much better alternatives available in the marketplace.

What cash apps give you cash instantly?

All of the instant cash apps with no credit check below and also listed in this article can give you access to cash instantly ranging from $20 to as high as $500.

-

- Dave — Best for Highest Cash Advance

- SoLo Funds — Best for Peer to Peer Loan funding

- Brigit — Best for Same-day Loans

- Earnin — Best for Earning-based Borrowing

- MoneyLion — Best for Multiple Options

- Possible — Best for Quick Cash Advances

- Empower — Best for No Interest and No Credit Risk

- Albert — Best for No Late Fees

- Cleo — Best for Quick Instant Loans

What’s the easiest app to get a cash advance?

Dave is one of the easiest cash advance apps with no credit, to get instant cash advance. The app offers up to $500.

Before payday, Dave is a trusted cash advance app that can give you extra cash but unlike other cash advance apps with no credit check on our list, it requires a $1 membership fee. Get the app here.

What Are Loan Apps and How Can They Help Me?

Loan apps cover small expenses of a few hundred dollars or less. Therefore, if you have a utility bill that’s past due or have to fill an unexpected prescription, loan apps will advance you the money and let you repay the funds with your next paycheck. As a result, if you don’t have emergency savings, loan apps are often an interest-free way to overcome financial challenges.

What app gives you 100 dollars?

Most instant cash advance apps with no credit check offer $100 loans if you qualify. Some may require you to start with lower amounts or have worse terms for higher amounts, so it’s important to read the fine print.

What app gives the most cash advance?

Dave offers up to $500 with the ExtraCash feature.

Earnin also offers up to $500, but the amount is based on hours worked.

Can you get instant cash advance apps with no credit check?

Yes, you can get instant cash advance apps with no credit check from the following top 10 list of instant cash advance apps mentioned above in this article.

How can I borrow $200 on Cash App?

On Cash App, go to the “Banking” header and select “Borrow.” Although Cash App Borrow isn’t available to everyone yet, it does allow you to borrow up to $200 as long as you meet their requirements.

If the “Borrow” option doesn’t appear, it isn’t available for you yet.